2024 1099-MISC Copy A Forms, 25 Pack

2024 1099-MISC Copy A Forms, 25 Pack

Couldn't load pickup availability

Kit Includes

Kit Includes

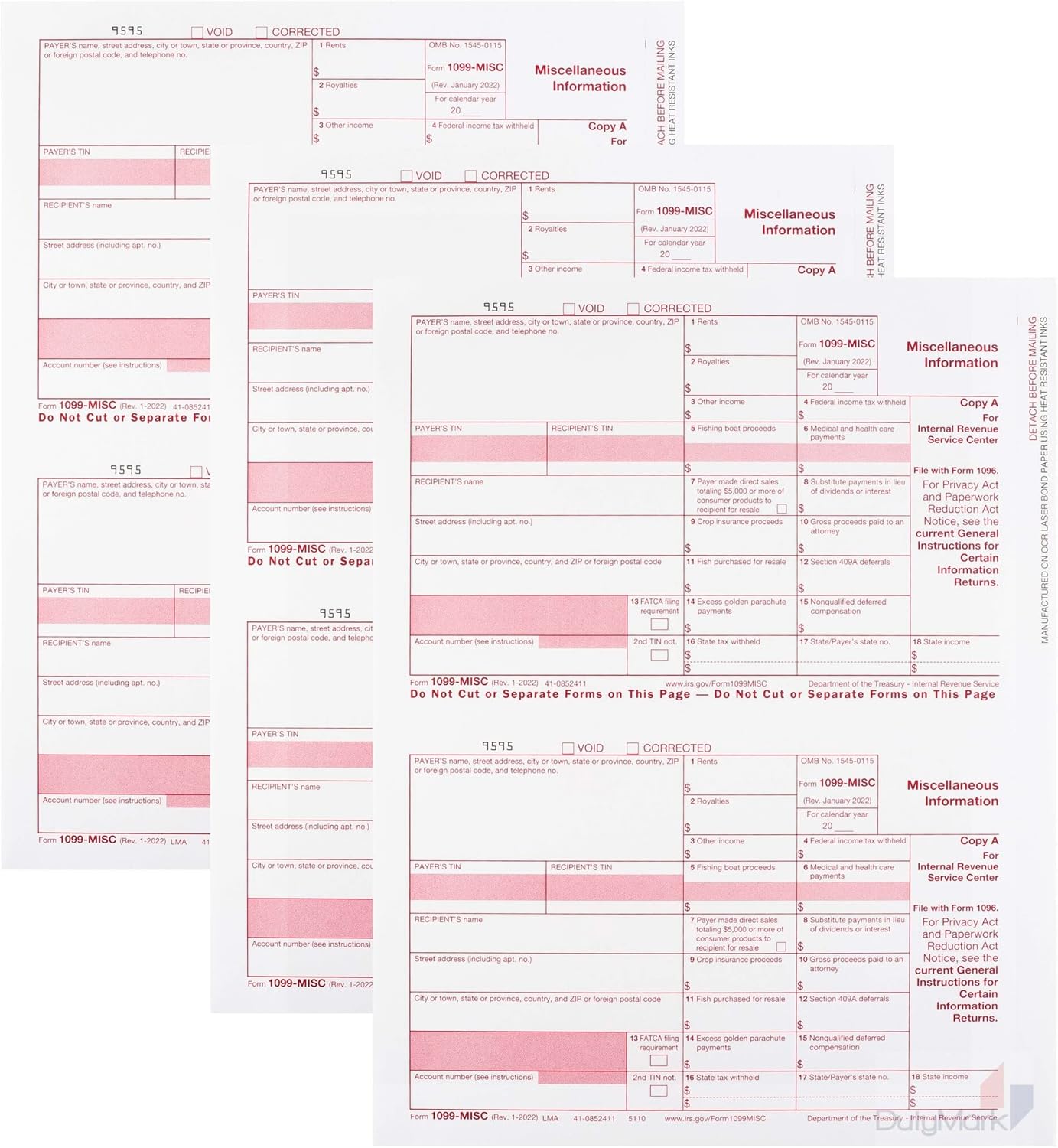

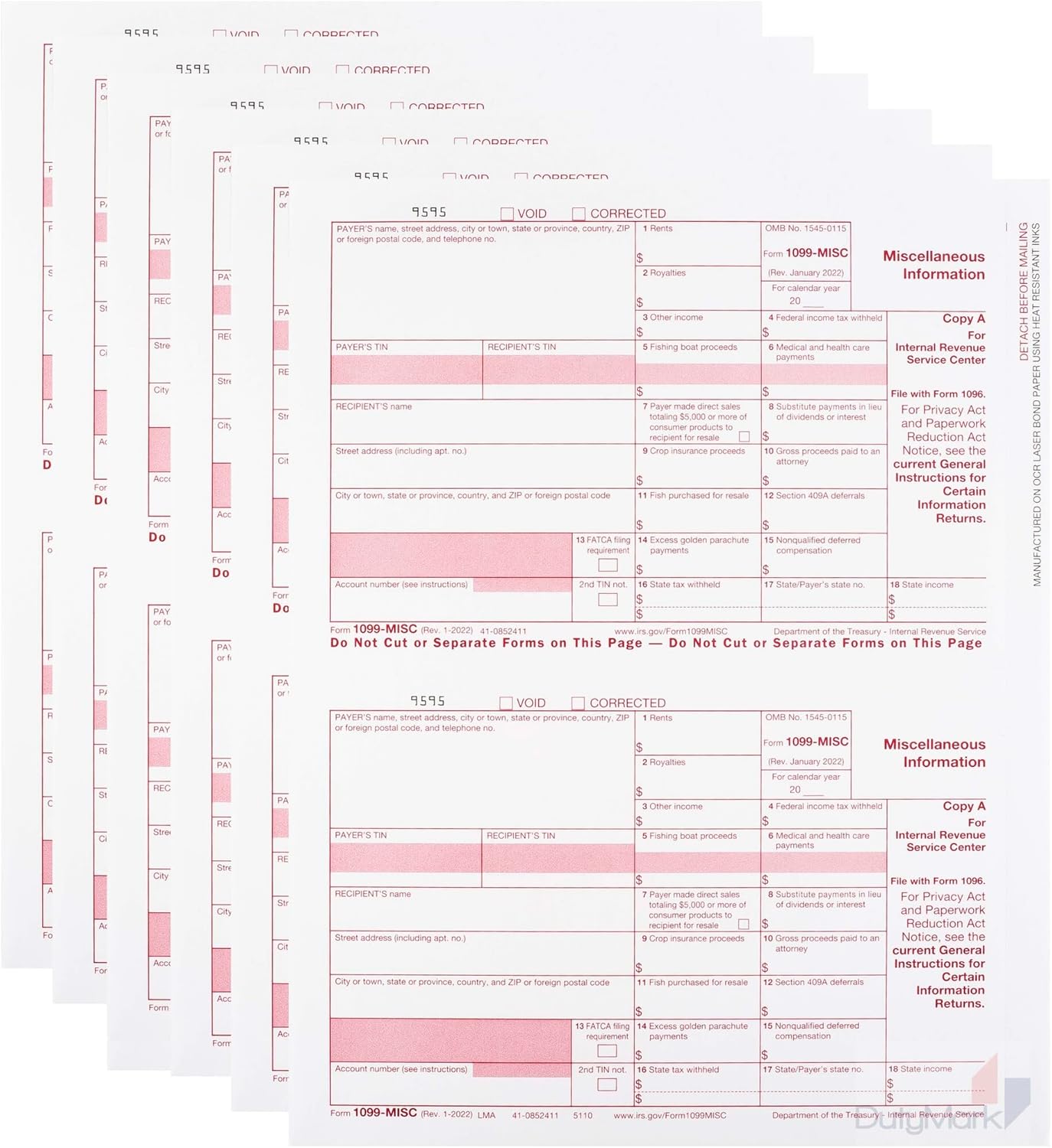

- This is Only Copy A Two filings per sheet

- 13 sheets 1099 MISC Copy A Forms for IRS, (2 forms per sheet) 26 Tax recipients

- Government approved 20# bond paper.

- Compatible with laser or inkjet printers.

- IRS Approve = Size 8 1/2" x 11

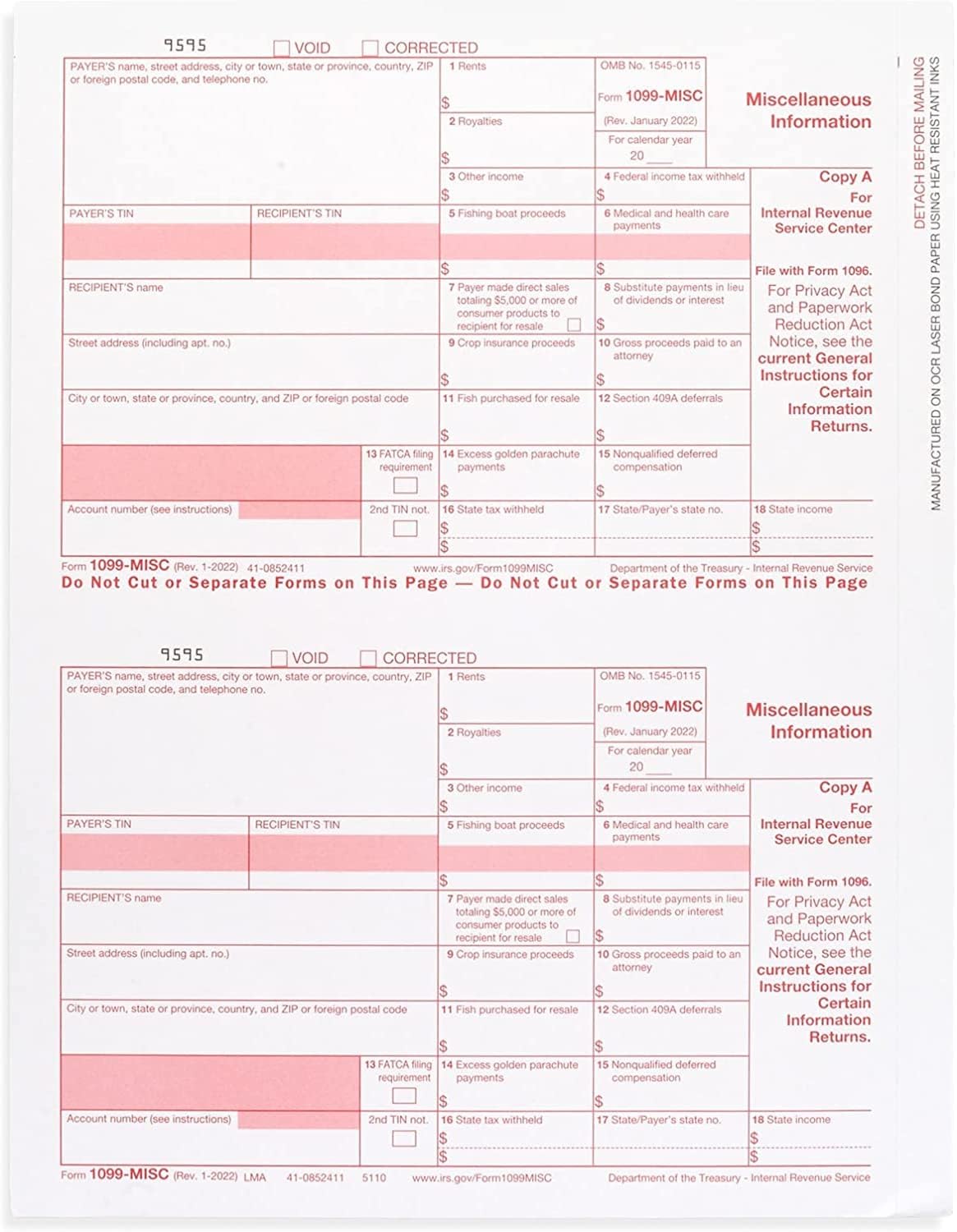

"Meets all government and IRS filing requirements.Popular format for reporting miscellaneous payments and non-employee compensation.

Quality Paper: Government approved 20# bond paper.

Paper Filing Due Date: To IRS, February 28th // To Recipient January 31st. Printer Compatibility.

Printer Compatibility: Compatible with laser or inkjet printers.

Tax forms per sheet: Two filings per sheet.

Amounts to Report: Generally, $600 or more (All Amounts or $10 or more in some cases)

[It’s IMPORTANT to know that the IRS has released 2024 a new form for reporting money your business pays to contractors. This new form, called the 1099-NEC, is short for Non-Employee Compensation,1099 miscellaneous form will still be required for reporting other income such as rent, royalties, healthcare payments, etc.]