1099 K Payee Copy B Tax Forms, PSE File Form, Pack of 100 Forms (50 Sheets)

1099 K Payee Copy B Tax Forms, PSE File Form, Pack of 100 Forms (50 Sheets)

Regular price

$28.49

Regular price

Sale price

$28.49

Unit price

per

Shipping calculated at checkout.

Couldn't load pickup availability

Kit Includes

Kit Includes

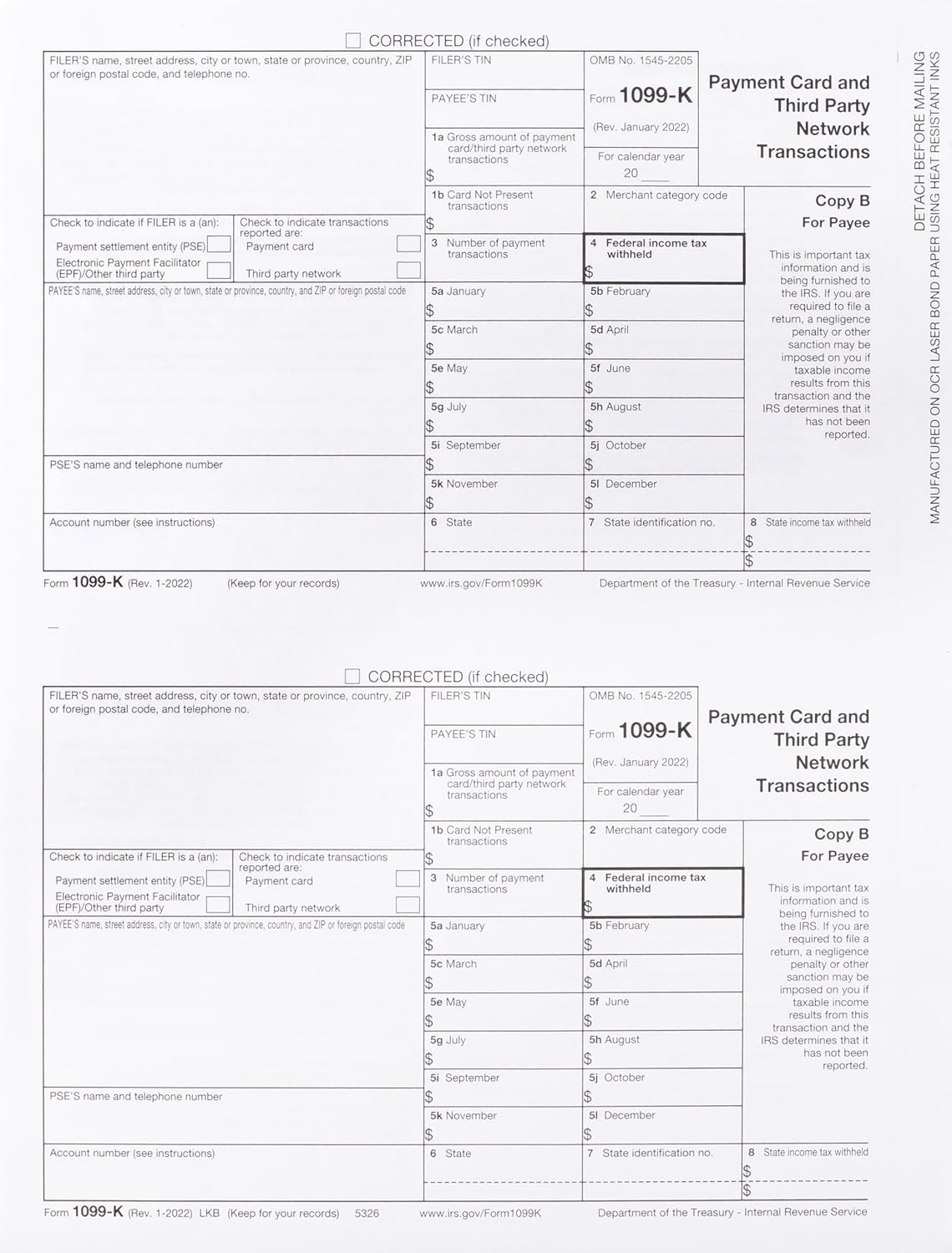

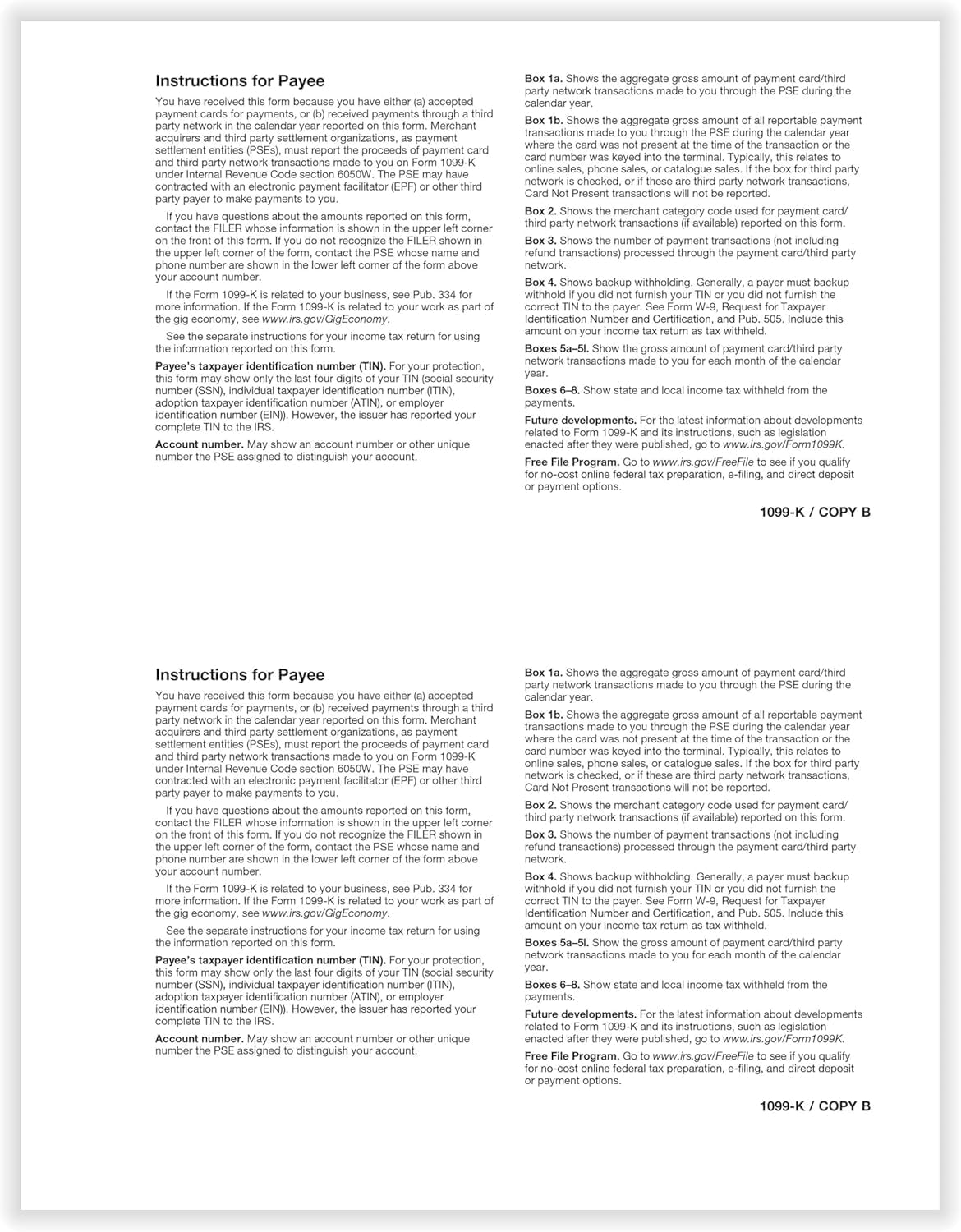

- 1099 K Tax Form Popular format is ideal for reporting merchant card and third party network payments. A PSE settles a reportable payment transaction, such as a payment card or third-party network transaction, by instructing the transfer of funds to the participating payee's account.

- Meets all government and IRS filing requirements. A payment settlement entity (PSE) must file Form 1099-K for payments made in settlement of reportable payment transactions for each calendar year.

- Use to Report: Income that you received from credit cards, debit cards, or other electronic payments, such as eBay and Pay Pal.

- Two filings per sheet. Whether domestic or foreign, a PSE is an entity, such as a bank or third-party settlement organization (TPSO), responsible for paying participating payees in payment card or third-party network transactions.

- Compatible with laser or inkjet printers. These tax forms are in 2-up forms where one sheet equals two forms. Each form measures 8-1/2-inches by 11-inches.